Curve Finance and the veCRV reward meta

An explainer on Curve Finance, veCRV, and third party veCRV vaults

What is Curve Finance?

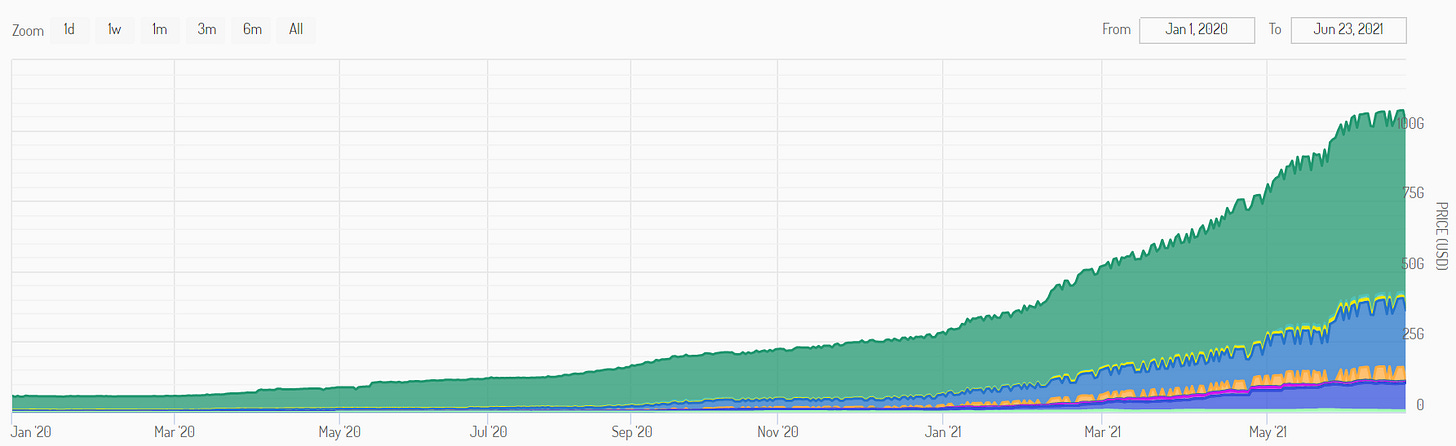

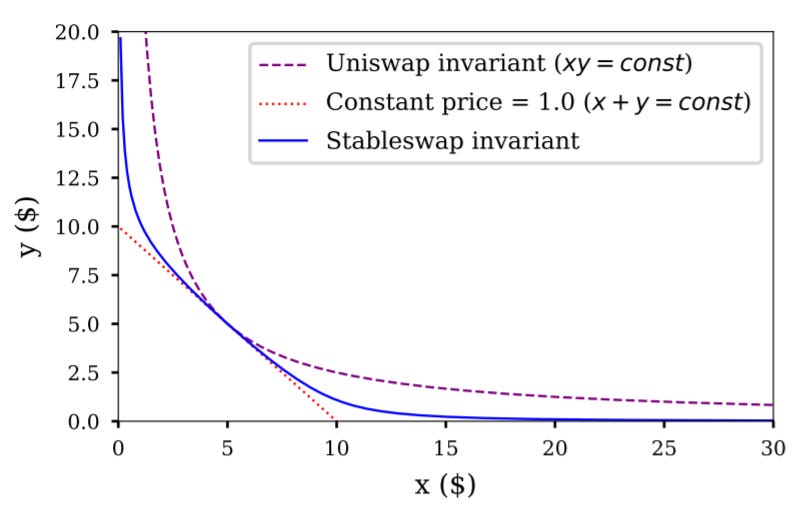

Curve (v1) is a multi-chain stablecoin based exchange liquidity pool. With current TVL of over $8b, it’s one of the largest DeFi protocols in the space. The rise of stablecoins over the past 18 months has been monumental, with the current stablecoin market cap over $100b (as predicted by Degen Spartan from eGirl Capital), and the market seeming to prefer stablecoin margined futures over coin margined futures more and more, ways to efficiently trade between different stablecoins has never been needed more.

In simple terms, Curve stablecoin pools provide a low fee, low slippage alternative to swapping stablecoins on centralised exchanges or other decentralized exchanges. It achieves this by using the StableSwap invariant, in contrast to the constant product invariant, as used by Uniswap v2, Bancor, etc. The StableSwap invariant implemented by Curve sits between a constant sum (x+y+z=k) and a constant product invariant, commonly known as x*y=k. It’s best visualised with this graphic from the Curve whitepaper. It is tuned to provide very low slippage with assets that are meant to be stable. This works for both USD pegged stablecoins like USDT and USDC, but also tokenized versions of other coins, like wBTC, sBTC for example.

Liquidity providers to Curve pools receive a cut of fees from swaps made in the pool, but because the pools also provide lending liquidity to protocols like Compound, they also receive interest, making it a great option for LP's. On top of this liquidity providers also get rewards in the form of CRV tokens, plus some pools offer incentives for providing liquidity, earning you even more rewards in other tokens. As a user looking to swap coins you get very low slippage, and lower fees when compared to centralized exchanges & other AMM's, making it a great option to swap stablecoins and tokenized coins.

What is CRV?

CRV is the governance and utility token for CurveDAO, the decentralized organization running the protocol. Liquidity providers on the platform earn CRV tokens as incentives. Currently the CRV token has 3 main uses - voting, staking and boosting. All three actions require the user to stake their CRV tokens to acquire veCRV. The longer you lock your CRV tokens for, the more veCRV you receive. Once your tokens are staked, you can earn a boost on rewards from liquidity providing (currently up to 2.5x), earn a share of the protocols trading fees (currently 50%), and also vote in governance proposals. veCRV is a way for the protocol to incentivise liquidity, but also ensure that governance participants are committed to the long term health of the protocol. veCRV holders are also eligible for certain airdrops.

Lets go down the rabbit hole

So locking your CRV for veCRV can provide pretty significant rewards, but is that all you can do? Well, enter Yearn Finance. Yearn Finance is a decentralized protocol focused on lending aggregation, yield generation, and insurance. Yearn vaults offer users 'passive' investing strategies. The vaults provide value to the user by automating the yield generation and rebalancing process, automatically shifting funds to new opportunities, and socializing transaction costs.

Due to the benefits of using the Curve protocol as discussed above, many of the Yearn vaults use Curve to generate yields, and as such receive CRV tokens as a reward. Yearn takes a portion of these rewards and deposits into their yveCRV vault, which boosts rewards for any Yearn vault using the Curve protocol. The yveCRV vault also accepts CRV deposits. Yearn then takes this liquidity and locks it in CurveDAO voting escrow. The vault locks the CRV tokens for the maximum 4 year timeframe, maximising rewards, and regularly prolongs the lock period (as the veCRV rewards decay linearly), this means that the vault does not have withdrawal functionality, deposited CRV is locked forever. Instead you earn a stream of 3CRV rewards. This means that you receive more yield from the yveCRV vault than you would if you were just staking your CRV yourself through the native protocol. At the time of writing the rewards are 85% more than doing this yourself.

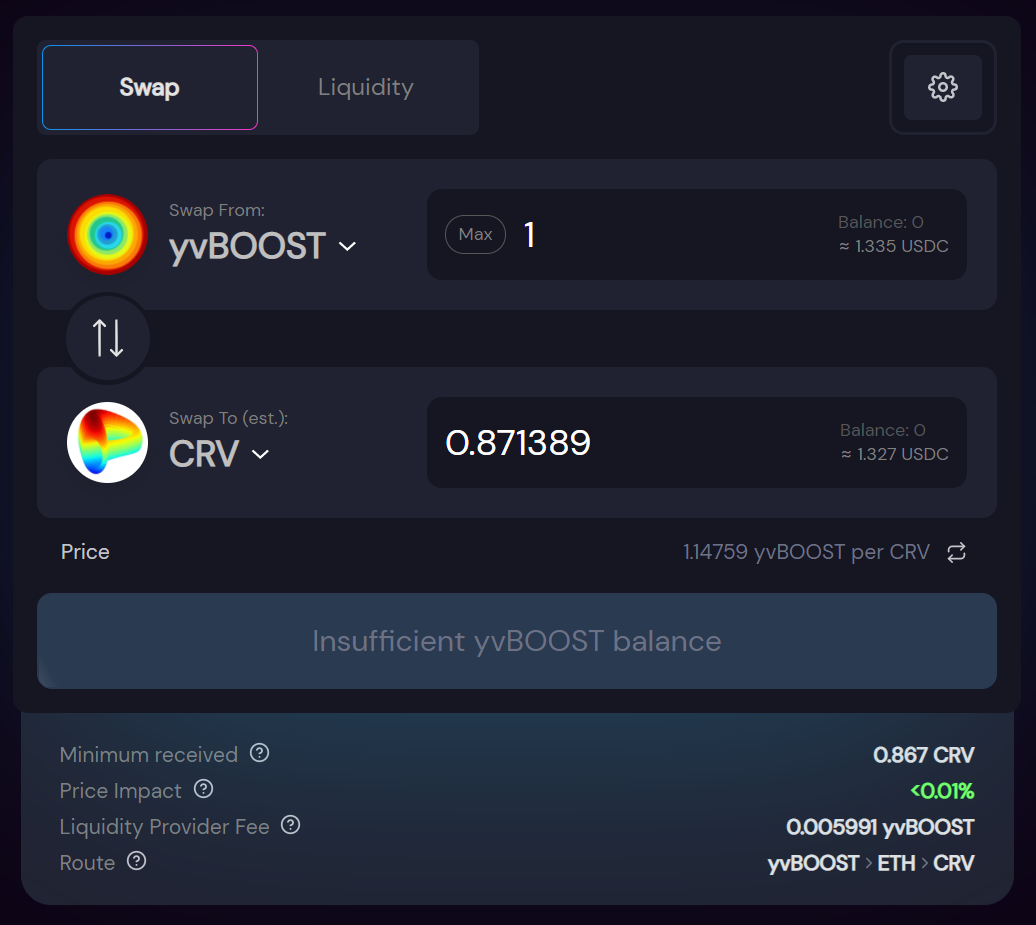

Native veCRV cannot be transferred, the only way to obtain it is by staking CRV. But as with all Yearn vaults the assets are tokenized, and you receive yTokens in return, this token can be traded. So not only can you lock CRV tokens to gain yveCRV, you can also buy yveCRV directly on SushiSwap. This opens another avenue for earning rewards, by providing liquidity on SushiSwap to the yveCRV-ETH pool. You can also use Pickle Finance to automatically harvest and compound your LP rewards, further increasing yield. Note however that if you are providing liquidity in this pool you will not be able to claim your 3CRV rewards as well. Yearn have since rolled the fund from yveCRV into the yvBOOST vault, which uses the 3CRV rewards to purchase more CRV, then deposits back into the vault. This creates a compounding CRV pool, while also increasing the the boost to all Yearn vaults using Curve Finance.

A new contender

But Yearn aren't the only protocol in the optimizing Curve rewards space. Enter, Convex Finance. Convex offers a similar solution to the one offered by Yearn, but with a few key differences noted below -

Yearn

lock CRV for yveCRV

10% of CRV earned through all Yearn vaults locked into yveCRV vault

tradeable in the yveCRV/ETH pool

3CRV rewards reinvested into pool

LP providers in the yvBOOST-ETH pool can stake their sushi LP tokens through Pickle Finance to earn more rewards

Cannot receive veCRV airdrops

no liquidity mining incentive

Convex

lock CRV for cvxCRV

10% of CRV earned through all Convex LP pools is sent to cvxCRV holders directly

tradeable in the cvxCRV/CRV pool

3CRV rewards distributed to cvxCRV holders

LP providers in the cvxCRV pool can stake their Sushi LP tokens to earn CVX

Can receive veCRV airdrops

earn extra CVX for using the cvxCRV vault

The key differences are that Convex add liquidity mining with CVX tokens distributed to cvxCRV holders, and the 3CRV rewards are not added back into the vault, they are distributed directly to cvxCRV holders. Note that these are just 2 of the projects using the veCRV vaults to provide yield to depositors, there are others like StakeDAO offering similar services.

Convex Finance has seen massive growth in their TVL since launch, with currently over $3b locked in the protocol, and over $55m locked in their cvxCRV vault.

While it may seem like Yearn and Convex are fighting for liquidity, C2tp from Convex Finance told Cointelegraph -

“We don’t really see it as direct competition. There are different platforms with different goals. There is also a lot to gain when platforms integrate with each as part of the larger DeFi system. We encourage anyone to use what we have to offer, as well as build on top. DeFi is not a winner takes all, but something that becomes stronger as all the pieces fit together.”

Banteg from Yearn Finance echoed this sentiment when he suggested Yearn could be creating CVX and cvxCRV vaults as a part of Yearns strategies.

De-peg

One interesting market dynamic that has emerged now that veCRV tokens are essentially tradable, is how much the protocols design affects the market price of these tokenized versions of veCRV. yvBOOST’s decision to purchase more CRV with the 3CRV rewards and locking them back in the pool has had the effect of de-pegging yvBOOST tokens from the underlying CRV tokens.

Whereas Convex’s decision to distribute the 3CRV rewards direct to cvxCRV holders, and add liquidity mining has meant cvxCRV tokens have maintained their peg with CRV more closely.

It will be interesting to see how this dynamic plays out over time, especially if new protocols enter the veCRV reward space.

Curve v2

Earlier this month Curve Finance announced the release of Curve v2, which is an AMM for volatile assets, similar to Uniswap v3 in ways. This rightfully deserves its own article, as it is quite complex, and has lots of potential implications for the AMM space.

Conclusion

Curve is one of the largest defi protocols in the space, with their optimized AMM techniques, innovative governance and voting mechanisms, and the flurry of projects built on top of their protocol, they have cemented themselves as one of the pillars of defi. I look forward to seeing what the team will produce moving forward.

- Miyuki Eto

this article was EXTREMELY informative

looking forward to more content 🔥

Awesome article. Thank you for explaining in such detail. WAGMI 🔥